Endow Iowa State Tax Credit

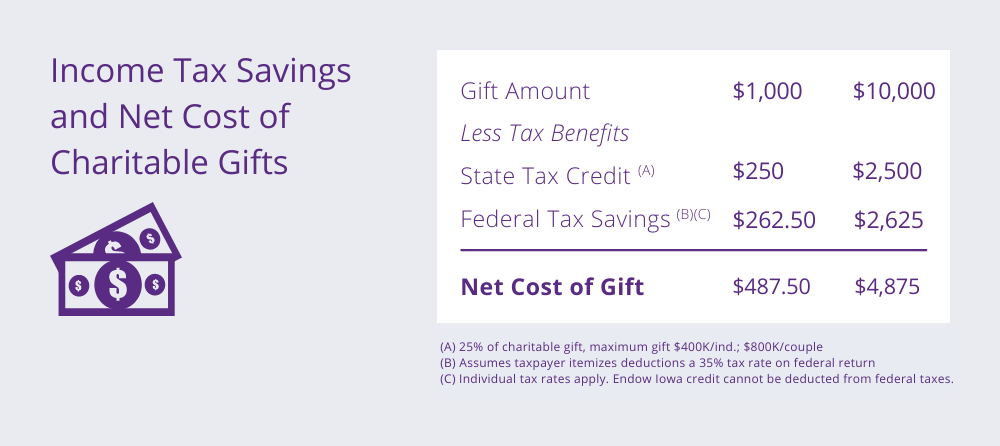

When you make an endowed gift to the Community Foundation of Greater Dubuque or any of its funds, it will cost you far less thanks to Iowa's generous Endow Iowa 25% State Tax Credit.

Gifts of $50 or more to endowed funds qualify for this generous benefit to you.

The innovative Endow Iowa program was established by Iowa state legislators to promote charitable giving to qualified permanent endowments and provide sustainable support to nonprofits in our state.

The tax credits are only available for qualified gifts made through a qualified Iowa community foundation, such as the Community Foundation of Greater Dubuque and our affiliates. Various types of gifts qualify including cash, stock, grain and retirement assets.

All 2023 credits have been allocated — however, your gift still counts!

The Iowa Economic Development Authority (IEDA) has paused the program, and no applications will be accepted for the remainder of the year. When the program re-opens — expected in early-2024 — you can apply for 2024 credits. IEDA will be launching a new form, and we will make sure to send it your way so you can apply.

- Once the program re-opens, individuals can apply for credits on up to $400,000 in gifts to endowment funds ($800,000 for couples).

- You have up to 12 months from the date of your gift to apply for credits.

- Credits are allocated on a first come, first served basis.

For more information, visit the IEDA website. We are here to assist you! Please email us at yourfund@dbqfoundation.org or call us at 563-588-2700.

The U.S. Treasury Department published the regulation, “Contributions in Exchange for State or Local Tax Credits,” on June 13, 2019, and it impacts Endow Iowa-qualified gifts made on or after August 28, 2018. Click here for more information on this regulation, known as SALT.

"I love my community, and I want to know that its future is a bright one with many possibilities. I encourage residents to learn more about the Endow Iowa tax credit and how the Community Foundation can secure our local future today and tomorrow."

Credits are given on a first-come, first-served basis.

This means not only is it important to make your gift, but also to fill out and return your Endow Iowa application as quickly as possible. The Community Foundation will mail this form to you after you make your gift. We will add as much information to the form as possible, making it easy for you to complete the form and mail it to:

Community Foundation of Greater Dubuque

Attn.: Emily Rollins

700 Locust St., Suite 195

Dubuque, IA 52001

All qualified donors can carry forward the tax credit for up to five years after the year the donation was made.

All 2023 Endow Iowa credits have been allocated, and the program is temporarily closed. If you make a gift during this time, you can apply for credits when the program re-opens in 2024, as long as you do so within 12 months of the date of your gift.